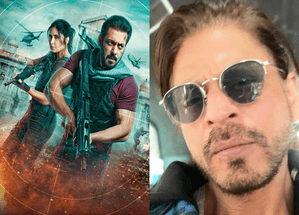

Aditya Chopra, head of Yash Raj Films, is keeping superstar Shah Rukh Khan’s presence in the ‘Tiger 3’ a surprise till the upcoming film releases.

A source said: “SRK a.k.a Pathaan’s presence in ‘Tiger 3’ is one of the biggest. Highlight points of this YRF Spy Universe movie. Adi is clear that he will not give out any image, any video of this big moment out for people to consume without them buying a ticket of Tiger 3!”

“Just like Salman Khan’s incredible clap-trap appearance in ‘Pathaan’ was kept. A secret, Adi will do the same with SRK’s part in ‘Tiger 3’!”

The source further revealed: “Aditya Chopra has made YRF Spy Universe the biggest theatrical franchise of the country. He wants euphoria in theatres when these spy films release and so, every beat. Of these movies, are being carefully crafted behind the closed doors of YRF.”

“Adi wants the YRF Spy Universe to stand for the biggest action spectacles that people of India could witness. So, one should expect that all the big surprises like these will only be unveiled to people in theatres.”

Directed by Maneesh Sharma, ‘Tiger 3’ is set to release this Diwali, November 12 in Hindi, Tamil and Telugu.