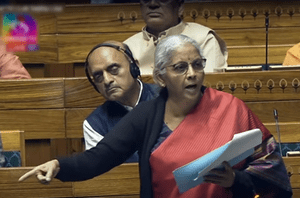

Google has suspended or removed over 2,500 fraudulent loan apps from its Play Store between April 2021 and July 2022 as the government and RBI are keeping a close watch to maintain cyber security, Finance Minister Nirmala Sitharman informed Parliament on Monday.

“As part of steps taken to control fraudulent loan apps, the RBI has shared a ‘whitelist’ of legal apps with the government, and this list was shared by the Ministry of Electronics and Information Technology (Meity) with Google, whose app store is the primary source of distribution of digital lending apps,” the Finance Minister said in a written reply in the Lok Sabha.

She said that the Google has updated its policy regarding enforcement of loan lending apps on the Play Store and has also deployed additional policy requirements with strict enforcement actions for lending apps in India.

She said that in accordance with the revised policy, only those apps are allowed on the Play Store which are published by Regulated Entities (REs) or those working in partnership with Res.

She said that Google had reviewed as many as 3,500 to 4,000 loan apps, between April 2021 and July 2022, out of which 2,500 were removed as they were found to be fraudulent.

She said that the Indian Cyber Crime Coordination Centre (I4C), functioning under the Ministry of Home Affairs, has been regularly analysing the digital lending apps proactively.

“Based on its analysis and complaints reported on the National Cyber Crime Reporting Portal, the I4C team analyses apps on various parameters and reports to Meity apps found suspicious for blocking,” Sitharaman said.

The issue of cyber fraud is also regularly discussed and monitored in the meetings of the Financial Stability and Development Council (FSDC), an inter-regulatory forum chaired by the Finance Minister.

She said that to spread awareness against cybercrimes and to safeguard interests of citizens, several steps have been taken by the government, the RBI, and banks.